The stock markets never fail to surprise investors. As we approached 2024, the big question was whether the U.S. might slip into recession or experience a so-called soft landing. Interest rates and inflation remained elevated, and of course, a contentious presidential election was getting underway. There were plenty of reasons to believe we would be in for a choppy or volatile road in 2024.

Yet, despite a stumble at the end of the year, stocks posted another solid year of returns. Once again leadership came from the super-sized technology names we all know and love. Nevertheless, the average stock appreciated right in line with its long-term average. It was a ho-hum year for foreign stocks (again), but that was due mainly to a strong rise in the dollar, which subtracted nearly 9% from foreign stock returns in the fourth quarter.

High-quality bonds, unfortunately, continued to struggle. This type of bond has underperformed T-bills for three of the last four years, with rising interest rates the primary culprit in the lagging returns. Other types of bonds, including high-yield and floating rates, managed to post solid returns. High-yield bonds are more influenced by what is happening in the stock market, while floating rate bonds actually benefit when interest rates rise.

The strong and consistent return for stocks in 2024 (without even a 10% correction) provided a nice tailwind for the FSA portfolios. All finished the year near all-time highs, despite the negative returns in December. For most of the year, the portfolios have emphasized large-cap domestic funds, shying away from foreign funds or funds that buy smaller companies. For strategies that hold bonds, we have favored high-yield bonds and more defensive areas of the bond market, like mortgage-backed funds and floating rate funds. We had made forays into traditional high-quality bond funds, but most of them hit our FSA Safety Nets® in December and we sold them.

Prospects for 2025

Stocks have posted two years of solid returns for investors. Granted, participation has been narrow, with most of the strong results coming from a handful of very large technology-oriented names like Nvidia, Alphabet, and Meta. However, the average stock has returned roughly 14% over that same period, well above its long-term average.

Should this period of strong returns offer confidence that the good times will keep rolling or serve as a warning to expect a change in the market trend? We looked at the years when the S&P 500 Index averaged 20% or more on a two-year basis. Two thirds of the time, stocks made additional gains in the third year, while one third of the time stocks finished the third year in negative territory. The takeaway here is that, just because stocks have posted strong returns two years in a row, it doesn’t mean they’re destined to weaken in the third year.

More important for equity prospects in 2025 is whether consumers continue to spend; whether unemployment remains low, as does inflation; and whether the Federal Reserve can continue to let short-term interest rates drift lower.

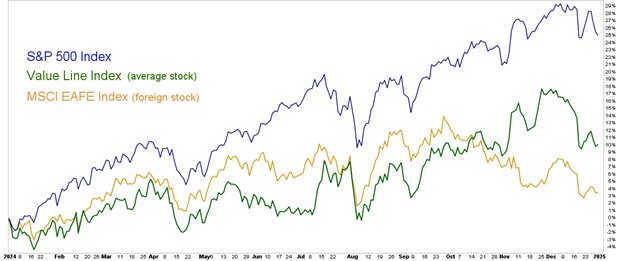

From a technical perspective (which is how we analyze markets), we remain positive, particularly for U.S. stocks, as the general trend is higher. The chart below shows the one-year path of returns for the S&P 500 Index, the Value Line Arithmetic Index (representing the average stock), and an index for foreign stocks. While the S&P 500 Index is clearly the strongest looking index (with its heavy influence by the technology mega-caps), only the foreign index shows a downward trend developing.

The start of every new year arouses a combination of excitement and trepidation about the stock market. For those of you optimistic about stocks continuing to climb in 2025, know that the portfolios are fully invested and ready to ride the trend higher. For those more nervous about what this year could bring, be assured we have the FSA Safety Nets® applied to each security within the active strategies and are prepared to sell if market conditions turn negative.

Portfolio Update

Keep in mind that because we manage clients’ portfolios individually, the holdings in your specific accounts may differ somewhat from the averages.

Strategies That Employ the FSA Safety Net®

Income (Strategy 1)

It was a mixed bag for bonds in 2024, with high-quality bonds finishing nearly flat for the year, while alternative types, such as high-yield, floating rate and mortgage-backed bonds, posted decent returns near 7%. The FSA portfolios held a mixture of all of these for much of the year; therefore, we managed to generate a decent return, above a T-bill return. During the quarter the high-quality bond funds hit their FSA Safety Nets®, so we sold them and put the proceeds in a floating rate fund and Schwab’s higher yielding money market fund. Currently, the portfolios hold 40% in high-yield bond funds and 40% in more eclectic and defensive bond funds, with roughly 20% in money markets.

Income & Growth (Strategy 2)

For clients who have serious concerns about the stock market but still want to capture consistent returns, with only modest drawdowns, this strategy remains a valid option. The equity allocation, at roughly 50%, contains a mix of defensive funds, along with several large-cap domestic funds. The fixed-income component, at 40% of the portfolio, consists of a mix of high- yield, high-quality, and eclectic bond funds. There is 10% in Schwab’s high yielding Value Advantage money market fund.

Conservative Growth (Strategy 3)

Our flagship balanced strategy had a solid year. The equity allocation remained near its maximum level of 75% all year, while the fixed-income allocation held high-yield bonds all year, one of the strongest areas of the bond market for 2024. With the leadership of the market continuing to come from a small number of giant technology names, it was a challenge for many of our favorite managed funds to keep up. Fortunately, we held several S&P 500-type funds for much of the year.

Core Equity (Strategy 4)

This all-equity strategy posted solid returns for the year, despite losing ground in December. The portfolios maintained a heavy allocation to equities all year, finishing the year at 98%. During the final quarter we added an industrials sector fund, but so far it has not helped the portfolios. As of January 2, the equity allocation consists of 75% S&P 500-type funds, so this strategy should continue to perform well if the S&P 500 Index remains in an uptrend.

Tactical Growth (Strategy 5)

With stocks in an uptrend, this aggressive strategy posted solid returns for the year. During the fourth quarter, we added a small-cap fund to some of the portfolios, as well as an industrials sector fund. Currently, these portfolios hold minimal money markets allocations.

Active Strategies WITHOUT the FSA Safety Net®

Sector Rotation

Last year was a lackluster year for this aggressive, all-equity strategy. Market environments that are narrow (with relatively few stocks participating) can be challenging since this strategy always owns six holdings. In a narrow market, only two or three sectors may be performing well, but this strategy will typically hold six, so that the weaker sectors offset the stronger ones. At the January rotation, the strategy holds financial and banking sectors, along with technology, internet, leisure, and transportation funds.

Global Rotation

This aggressive, go anywhere strategy had another good year, participating nicely in the rally by riding the growth bandwagon for much of the year. The current portfolio includes roughly 50% in large-cap growth funds, 30% in S&P 500 funds, and 16% in a mid-cap growth fund.

Strategies That Remain Fully Invested Through ALL Market Cycles

Global Balanced

The newest passive portfolio, which always holds roughly 50% in stocks and the other half in bond funds, was designed for more conservative or income-oriented investors, seeking some participation from equities, while balancing that with the relative safety of fixed income.

Global Moderate

This strategy posted solid returns for the year, thanks to the 70% allocated to equities. Even though real estate and foreign stocks were a drag on returns, the allocation to small-cap stocks and large-cap stocks and gold provided sufficient lift.

Global Growth

This strategy posted decent returns for 2024, with the large-cap and small-cap allocations (along with gold) providing the strongest returns, while the foreign and real estate allocations were a drag on returns.

Please remember to inform your advisor of any changes in your life that might affect your investment objectives and how we manage your money.

Ronald Rough, CFA

Chief Investment Officer

Disclosures are available at www.fsawealthpartners.com/disclosures/market-update.

FSA’s current written Disclosure Brochure and Privacy Notice discussing our current advisory services and fees is available at www.fsawealthpartners.com/disclosures or by calling 301-949-7300.