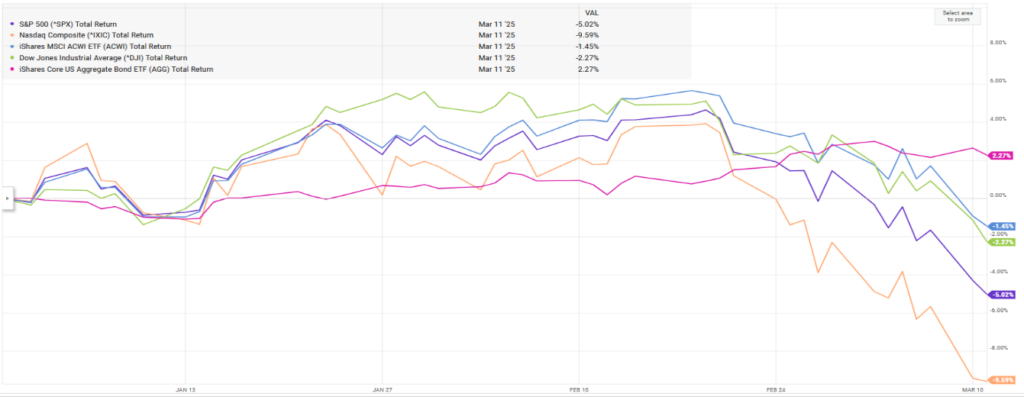

Stocks in the U.S. started the year on a pretty firm foundation, with the S&P 500 Index hitting a new all-time high in late February. Unfortunately, the tone has turned decidedly dour over the past few weeks, with the S&P 500 Index falling over 8% through March 10. At this point all of the major U.S. indices are down for the year. Interestingly, bonds are providing a safe haven for investors, with high yield and high-quality bonds up between 1.5% and 2.5% for the year. The underperformance of U.S. equities can be attributed to several factors, most notably concerns about a potential economic slowdown and the ongoing uncertainty of President Donald Trump’s tariffs.

As traders reassess their outlook for the economy, particularly after the optimism at the start of the year, there are growing worries about the toll tariffs might take on the U.S. economy. Earlier assumptions that the current administration’s pro-business stance would outweigh inflationary pressures are being questioned, as economic data suggests a potential slowdown.

The Impact of Tariffs on the Economy

Tariffs, which are essentially U.S taxes imposed on imported goods, can disrupt the economy in both the short and long term. While they are designed to protect domestic industries by making foreign goods more expensive, their broader economic consequences are more complex. On the positive side, tariffs can encourage consumers to buy domestically produced goods, which can help preserve jobs in certain sectors. Additionally, tariffs generate government revenue.

However, the negative impact of tariffs is becoming more evident. As tariffs raise the cost of imports, businesses typically pass those increased costs onto consumers, resulting in higher prices for a wide range of products. This can dampen consumer spending and slow economic growth. Furthermore, businesses that depend on imported raw materials or components face higher production costs which can affect profitability. In some cases, this could result in reduced hiring, lower wages, or layoffs, further affecting the economy.

The disruption of global supply chains is another significant consequence of tariffs. With today’s globalized economy, many businesses rely on imports to source raw materials or finished goods at lower costs. Tariffs can force companies to find new, often more expensive suppliers, which can introduce inefficiencies and raise prices. These shifts can also lead to reduced competitiveness as businesses struggle to adapt to the changing environment.

Moreover, tariffs can fuel trade wars, as other countries retaliate with their own tariffs, exacerbating the problem and further reducing international trade. In the worst-case scenario, tariffs can contribute to stagflation, an economic condition where inflation rises while growth stagnates. This combination of rising prices and slower economic growth can be particularly harmful, as it reduces purchasing power without providing the offset of a growing economy.

Bond Market Dynamics and Economic Uncertainty

In the bond market, the classic 60/40 stock-and-bond portfolio strategy typically relies on bonds serving as a hedge during stock market downturns. However, this traditional relationship has been disrupted recently. At the end of last year, despite inflation concerns, bonds and equities seemed to move in closer tandem as Treasury yields remained elevated even after the Federal Reserve cut rates three times.

Now, with economic data increasingly pointing to the possibility of a recession, there is growing concern about the future trajectory of the U.S. economy. Fears of stagflation are rising as inflationary pressures persist while growth shows signs of slowing. This uncertainty has led investors to seek refuge in the bond market.

The bond rally in February underscores the market’s growing caution and the need for diversified strategies that can help shield portfolios from these uncertainties. As we continue to navigate a complex economic landscape, investors are reminded of the importance of balancing risk and opportunity.

Looking Ahead

As we move forward, the economic outlook remains uncertain. While the bond market’s strength offers some protection, the challenges posed by tariffs, inflation, and slowing growth cannot be ignored. Rest assured, the FSA Safety Nets® are working overtime. This approach is designed to help protect portfolios by triggering sales should the technical indicators continue to break down. In the first week of March, we have had several trades in the portfolios, most notably shifting our more conservative models away from growth and reducing our exposure to the S&P 500 Index. We have also trimmed back leveraged positions in our more aggressive models. If the market continues to decline or technical indicators worsen, we will accelerate our cash-raising efforts and increase our cash position more aggressively to strengthen our defensive stance.

Our hearts go out to those whose employment is being impacted or in question. Please remember to inform your advisor of any changes in your life that might affect your investment objectives and how we manage your money. We are here to help.

Chris Jones

Senior Trader

Disclosures are available at www.fsawealthpartners.com/disclosures/market-update.

FSA’s current written Disclosure Brochure and Privacy Notice discussing our current advisory services and fees is available at www.fsawealthpartners.com/disclosures or by calling 301-949-7300.