Although we just sent out our April Market Update last Thursday, the recent sharp movements in both the stock and bond markets warrant a brief follow-up. We want to share how our various strategies are currently positioned and what we’re watching as we consider our next move.

Yesterday, the stock market staged an impressive rebound, with the S&P 500 climbing nearly 10%. While it was a welcome move, it’s important to view it in the context of the prior decline. Over the past few weeks, as volatility increased and markets pulled back, many of our strategies tripped their FSA Safety Nets®, prompting us to raise cash and increase allocations to money markets and inverse funds.

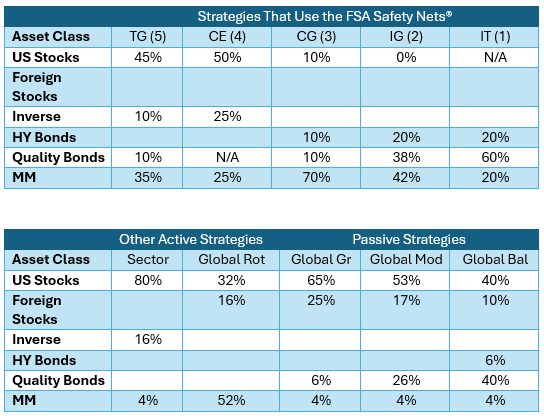

Today, markets have given back some of yesterday’s gains—highlighting the ongoing uncertainty and rapid changes we’re seeing. We don’t know exactly what lies ahead, but we remain focused on monitoring key indicators to guide our next moves. Here are the broad allocations of the ten strategies that FSA manages. Keep in mind your specific allocation may vary since these accounts are separately managed:

We’ve included a chart below showing the S&P 500 Index, along with the red line representing the major trend line we track. Even with the strong rally, the index remains below this key level. As a result, we are maintaining a defensive position within the five strategies governed by the FSA Safety Net®. While trend lines are one of the tools we use to assess market health, other internal indicators are also pointing toward a cautious stance for now.

Looking ahead, the market may recover further and signal a return to more stable conditions—or it could remain choppy. If we see sustained improvements, we will begin methodically re-investing. Either way, the coming days and weeks will be busy ones for the Investment Management team and all of us at FSA as we continue to manage your portfolios with discipline and care.

As always, we’re here if you have questions about your portfolio or the markets.

Disclosures are available at www.fsawealthpartners.com/disclosures/market-update.

FSA’s current written Disclosure Brochure and Privacy Notice discussing our current advisory services and fees is available at www.fsawealthpartners.com/disclosures or by calling 301-949-7300.